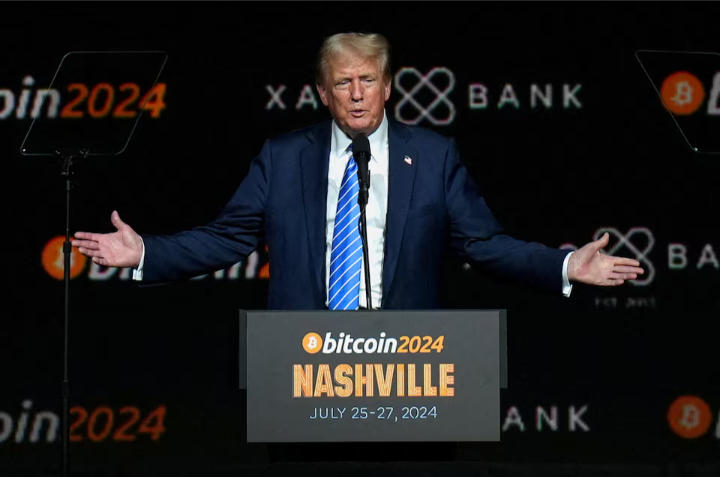

In a bold move just before his inauguration, President Donald Trump, alongside his sons and advisor Steve Witkoff, unveiled World Liberty Financial—a decentralized finance (DeFi) venture that swiftly amassed over $300 million through token sales. These tokens, distinct from traditional cryptocurrencies like Bitcoin, grant holders voting rights on product features and marketing strategies, marking a novel approach in the crypto landscape.

The allure of Trump's direct involvement attracted prominent investors, including crypto entrepreneur Mike Dudas, who invested approximately $145,000, and Justin Sun, founder of the Tron blockchain network, who acquired tokens worth $75 million. This influx of high-profile backers underscores the magnetic pull of the Trump brand in the financial sector.

However, the venture has sparked ethical debates. Critics express concerns over potential conflicts of interest, especially given Trump's dual role as a business magnate and the nation's leader. The rapid appreciation of the $TRUMP meme coin, reaching a market cap of $7.7 billion, further intensifies scrutiny over the intertwining of political influence and personal financial gain.

Despite these apprehensions, legal experts note that current federal regulations exempt the president and vice president from certain conflict-of-interest laws, suggesting no legal boundaries have been crossed. Nonetheless, the situation highlights the complexities and potential pitfalls when political figures engage directly in volatile financial markets like cryptocurrency.

As World Liberty Financial continues to evolve, its trajectory will likely serve as a case study in the convergence of politics, business, and emerging financial technologies. The venture's success or failure could have lasting implications for how future administrations navigate personal business interests while holding public office.